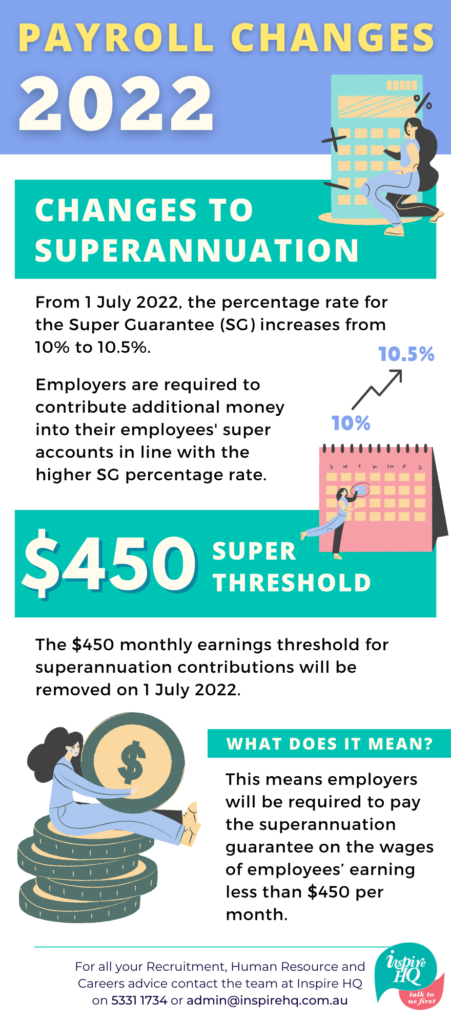

As the new financial year approaches, there are some key superannuation changes to be aware of that come into effect from 1 July 2022.

What’s changing?

- Super contributions increase from 10% to 10.5%

- Eligible workers aged 18 years or older earning less than $450 a month before tax will be entitled to receive the compulsory super guarantee (SG) payment from their employees

How to prepare:

- Review your payroll and accounting systems, updating them to ensure that you continue to pay the correct amount of super for your employees.

- Ensure your employee’s information is correct and updated in your systems to ensure you have the correct details for EOFY.

- If you are unsure about your obligations, The Australian Taxation Office provides a Superannuation guarantee contributions calculator which helps you work out the SG amount you will need to pay.

For all your Human Resources advice, call 03 5331 1734 to book your free Inspire HQ People Hour.

For more information, visit our Human Resources page.